Income offset by business expenses. You may not owe taxes however, if your crowdfunding campaign is deemed a trade or active business (and not a hobby) your business expenses may offset your tax liability.įactors affecting which expenses could be deductible against crowdfunding income include whether the business is a start-up and which accounting method (cash vs.

Kickstarter vs gofundme pro#

Taxable income. Since you raised $35,000, that amount is considered taxable income. As such, it may be subject to sales and use tax. Taxable sale. Because you offered something (a gift or reward) in return for a payment pledge it is considered a sale. Your campaign is more successful than you anticipated it would be and you raise $35,000–more than twice your goal. You run a Kickstarter campaign to raise additional funding, setting a goal of $15,000 and offer a small gift in the form of a t-shirt, cup with a logo or a bumper sticker to your donors. Say you develop a prototype for a product that looks promising. Let’s look at an example of reward-based crowdfunding. Up to $15,000 per year per recipient may be given by the “gift giver.” However, money donated or pledged without receiving something in return may be considered a “gift.” As such the recipient does not pay any tax. An easy way to circumvent this issue is to make sure when you are setting up a crowdfunding account such as GoFundMe you clearly designate whether you are setting up the campaign for yourself or someone else.Īgain, as noted above, as the beneficiary, all income you receive, regardless of the source, is considered taxable income in the eyes of the IRS–including crowdfunding dollars. If you are acting as “the agent”, and establish that you are indeed, acting as an agent for a beneficiary who is not yourself, the funds will be taxable to the beneficiary when paid–not to you, the agent.

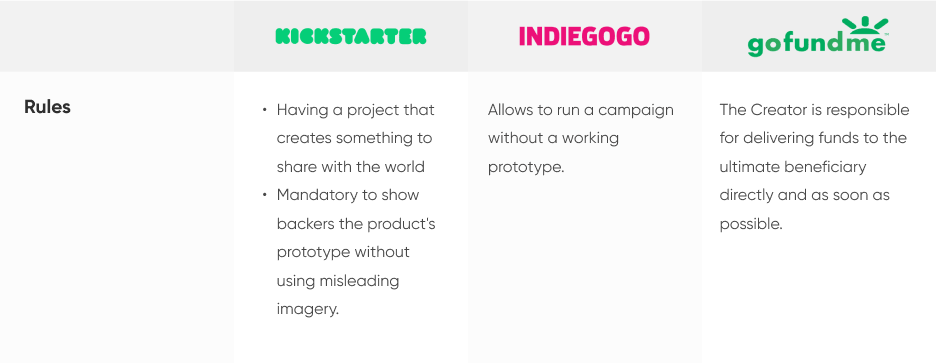

If you are both the agent and the beneficiary you would be responsible for reporting this income. As the agent, or person who set up the crowdfunding account, the money goes directly to you however, you may or may not be the beneficiary of the funds. Reward-based crowdfunding involves an exchange of goods and services for a monetary donation, whereas, in equity-based crowdfunding, donors receive equity for their contribution. GoFundMe is the most well-known example of donation-based crowdfunding with pages typically set up by a friend or family member (“the agent”) such as to help someone (“the beneficiary”) pay for medical expenses, tuition, or natural disaster recovery. Donation-based crowdfunding is when people donate to a cause, project, or event. There are three types of crowdfunding: donation-based, reward-based, and equity-based. Now it is used to fund a variety of projects, events, and products and in some cases, has become an alternative to venture capital. Crowdfunding was initially used by musicians, filmmakers, and other creative types to raise small sums of money for projects that were unlikely to turn a profit. What is Crowdfunding?Ĭrowdfunding is the practice of funding a project by gathering online contributions from a large group of backers.

The upside is that it’s often possible to raise the cash you need but the downside is that the IRS considers that money taxable income. Crowdfunding websites such as Kickstarter, GoFundMe, Indiegogo, and Lending Club have become increasingly popular for both individual fundraising and small business owners looking for start-up capital or funding for creative ventures.

0 kommentar(er)

0 kommentar(er)